The obvious next steps for these services is AI chat, for real time health questions. Dr. Google, Dr. Claude, etc. are great for researching health topics, but the results are generic and not personalized. And how many times has your AI health query led to a 3 AM wake up obsessing that everything is cancer?! The future is an AI agent that knows you better than your doctor and uses your personalized health data to curate analysis backed by the knowledge, research, and experience of millions of doctors.

THE BOTTOM LINE

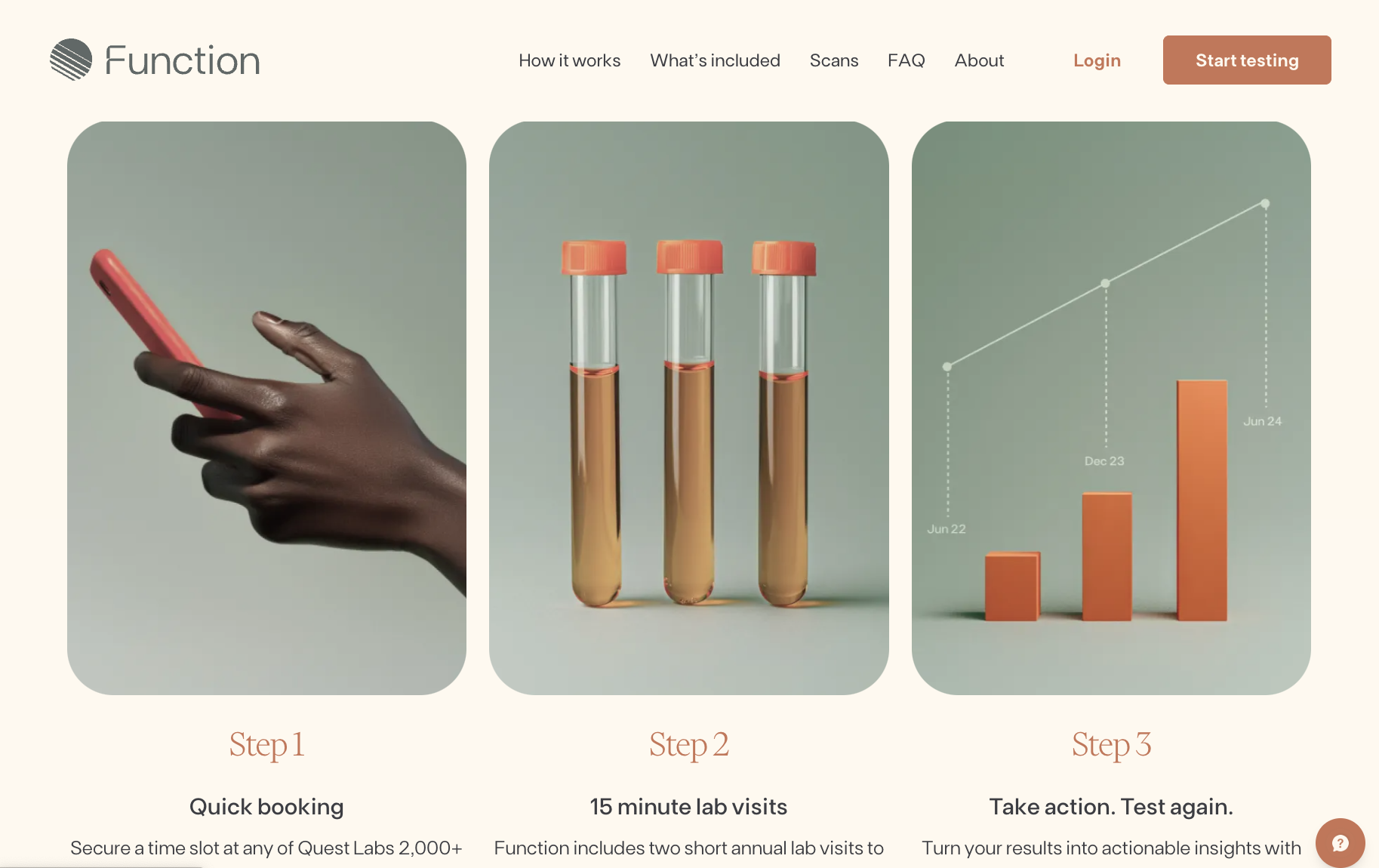

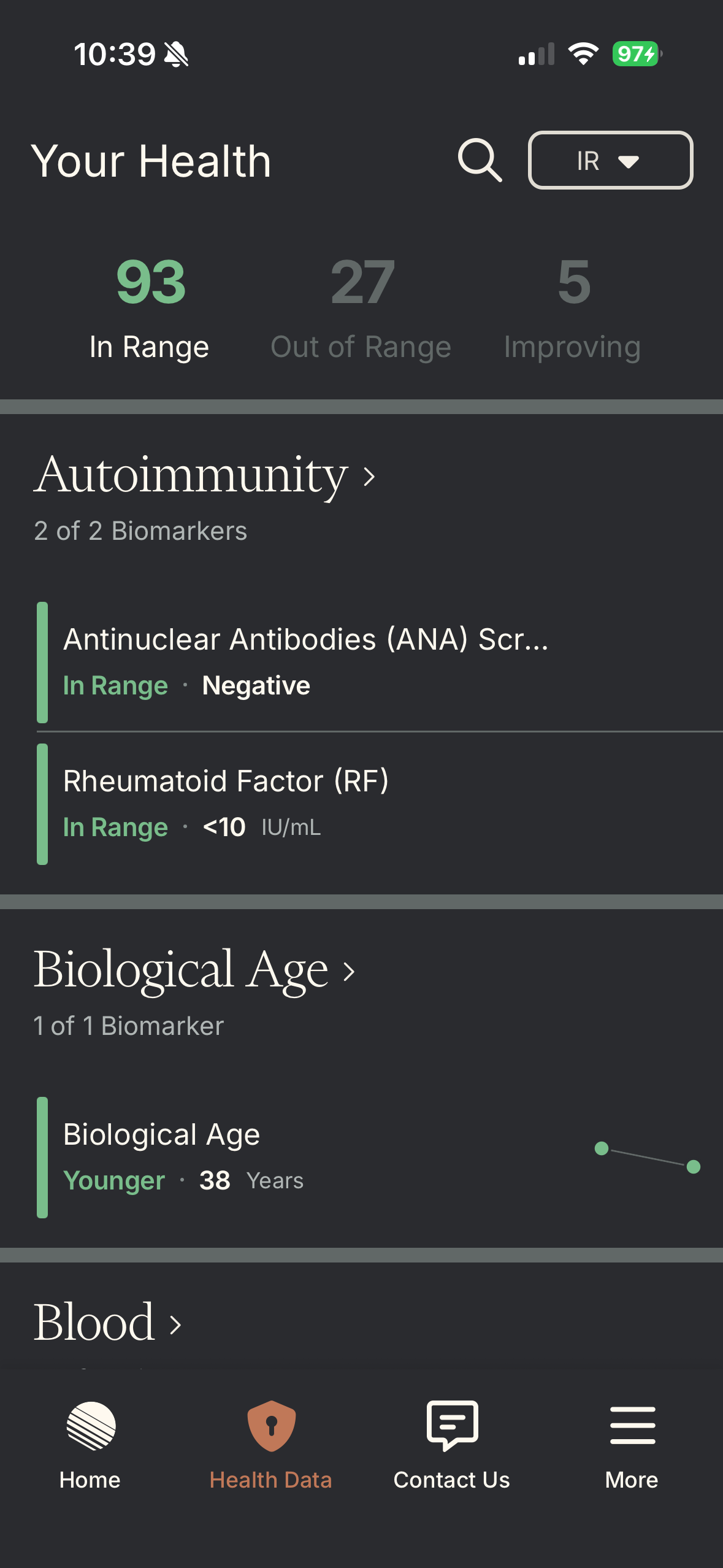

Both Function Health and Superpower are built on the idea that traditional physicals are a relic of the past. Why wait for something to go wrong when you can get an early warning system for your health? They both offer a wide range of biomarker tests, far more than you’d get in a typical check-up. We’re talking about a deep dive into your hormones, your metabolism, your heart health, and more. The goal is to empower you with data so you can make smarter decisions about your health and lifestyle.

For now, Superpower is slick and their design is beautiful, but the substance is not quite there yet, and Function Health is the clear winner. Their platform is more mature, their analysis is more transparent, and their clinician's notes are insightful. If you're serious about taking control of your health and you're willing to invest the time and money, Function Health is the way to go.

Don’t wait, give Function Health a try, here’s a referral link, but also check for new member discounts.